-

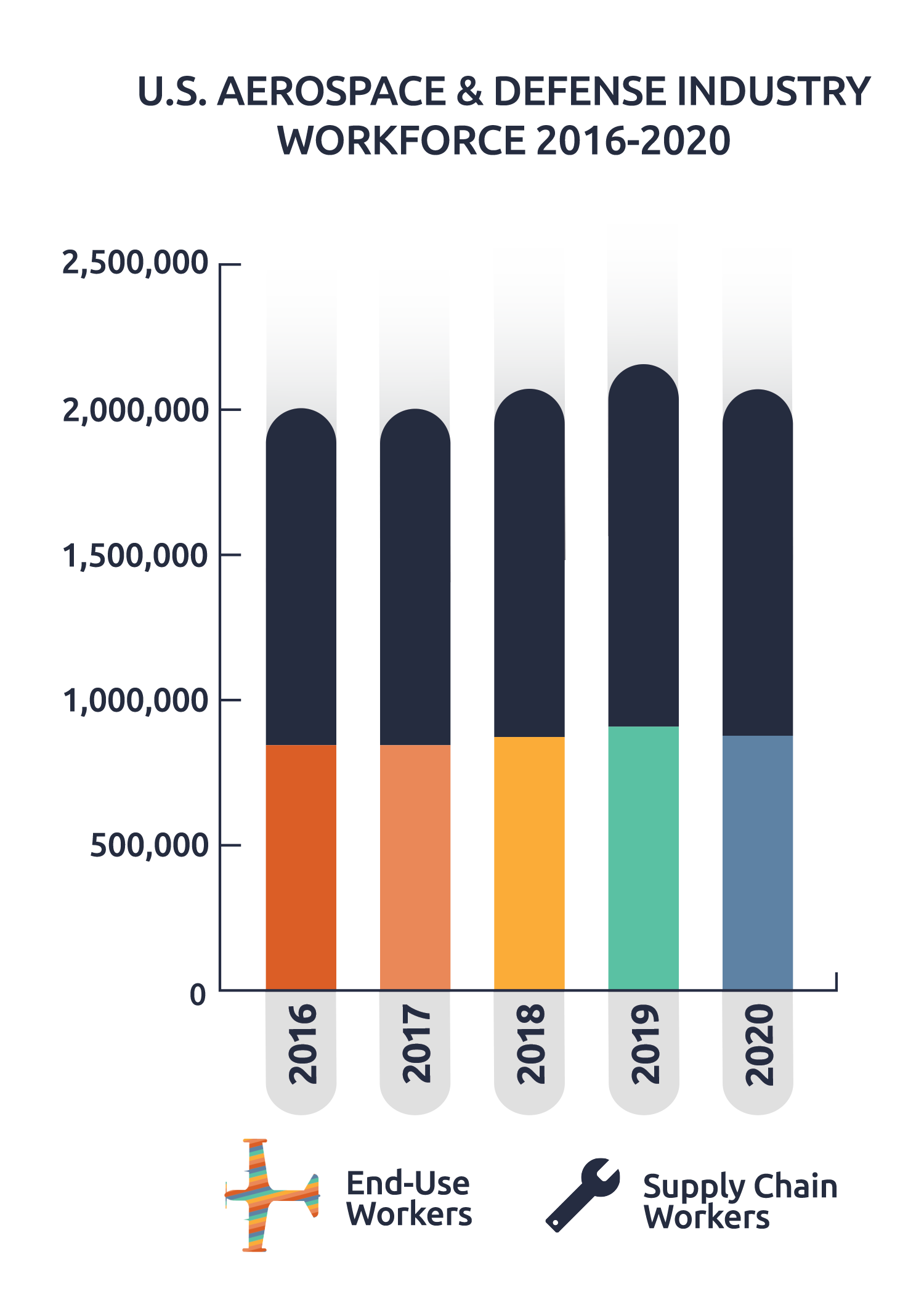

Aerospace & Defense Supports Nearly 2 Million American Jobs

Job loss is one of the most critical economic indicators in 2020 and the U.S. aerospace and defense industry was not immune from the declines in employment. Air travel slowed to a near halt, the demand for new aircraft and maintenance, repair, and overhaul services evaporated, and facilities were forced to temporarily close in accordance with government health orders. Consequently, the industry saw a net loss of more than 87,000 employees, a 4 percent decline when compared to 2019 industry employment.

Despite the impacts of the pandemic, our workforce remained nearly 2 million strong in 2020, with A&D industry jobs represented 1.4% of all employment in the United States.

-

Average Industry Wages and Benefits 41% Higher Than the National Average

At $104,577, the A&D industry’s average wages and benefits remained 41% above the comparable national average.

In total, the industry paid out $218.6 billion in compensation in 2020, or roughly 2 percent of total U.S. labor income.

-

A&D Workers Supported Their Communities in Times of Crisis

The industry made considerable tax payments to federal, state, and local tax authorities in 2020, even at a time of intense impacts to such accounts due to losses in other industries and sectors. Overall, the industry’s combined tax contributions combined for a total of $59 billion nationwide.

Additionally, AIA member companies have publicly donated at least $500 million to Pandemic-related causes. Further assistance was provided by our workforce, who logged thousands of volunteer hours throughout 2020. They setup laptops for grade school students, helped staff hospital testing centers, supported those in isolation by providing social contact, made or donated face masks, and fundraised for various relief efforts in their free time.

American life changed dramatically in 2020, forcing extraordinary—and previously unimagined—shifts in the Aerospace & Defense (A&D) industry. COVID’s impact was immediate and profound. Commercial aviation ground to a near halt as our nation and world contended with massive headwinds that COVID-19 generated. The defense sector also faced challenges as a patchwork of government mandates and restrictions initially complicated operations. As a consequence, the shared A&D supply chain, comprising thousands of small and medium-sized companies across the country, faced immense financial and logistical challenges to support existing defense sector contracts and replace lost civil sector sales.

This year’s Facts & Figures: Aerospace & Defense helps us examine these shifts to better understand the position in which industry now finds itself, as well as the opportunities for our workforce and our businesses that are on the horizon.

Jobs

Economic Output

-

Industry Sales Revenue Dropped to $874 Billion

Mirroring the impacts to our workforce, the industry’s revenues experienced a decline in 2020. Between 2019 and 2020, the total industry revenues dropped 2.8 percent to $874 billion, with the supply chain feeling a far greater burden at a loss of more than 3 percent.

-

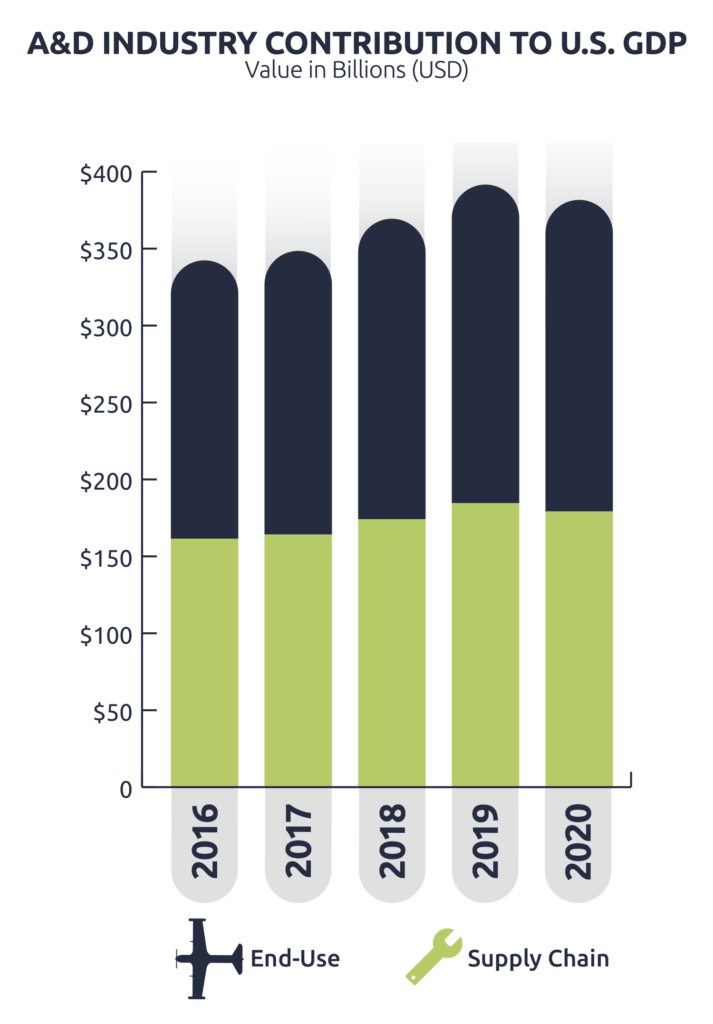

A&D Sales Represented 1.8% of the Total U.S. GDP

Though suffering significantly from the pandemic, the industry continues to boast impressive contributions to the American economy. In 2020, the A&D industry’s sales activity contributed 18.8 percent of all non-food manufacturing revenue in the nation. Additionally, the industry accounted for 1.8 percent of total U.S. GDP, a figure of around $382 billion.

Trade

-

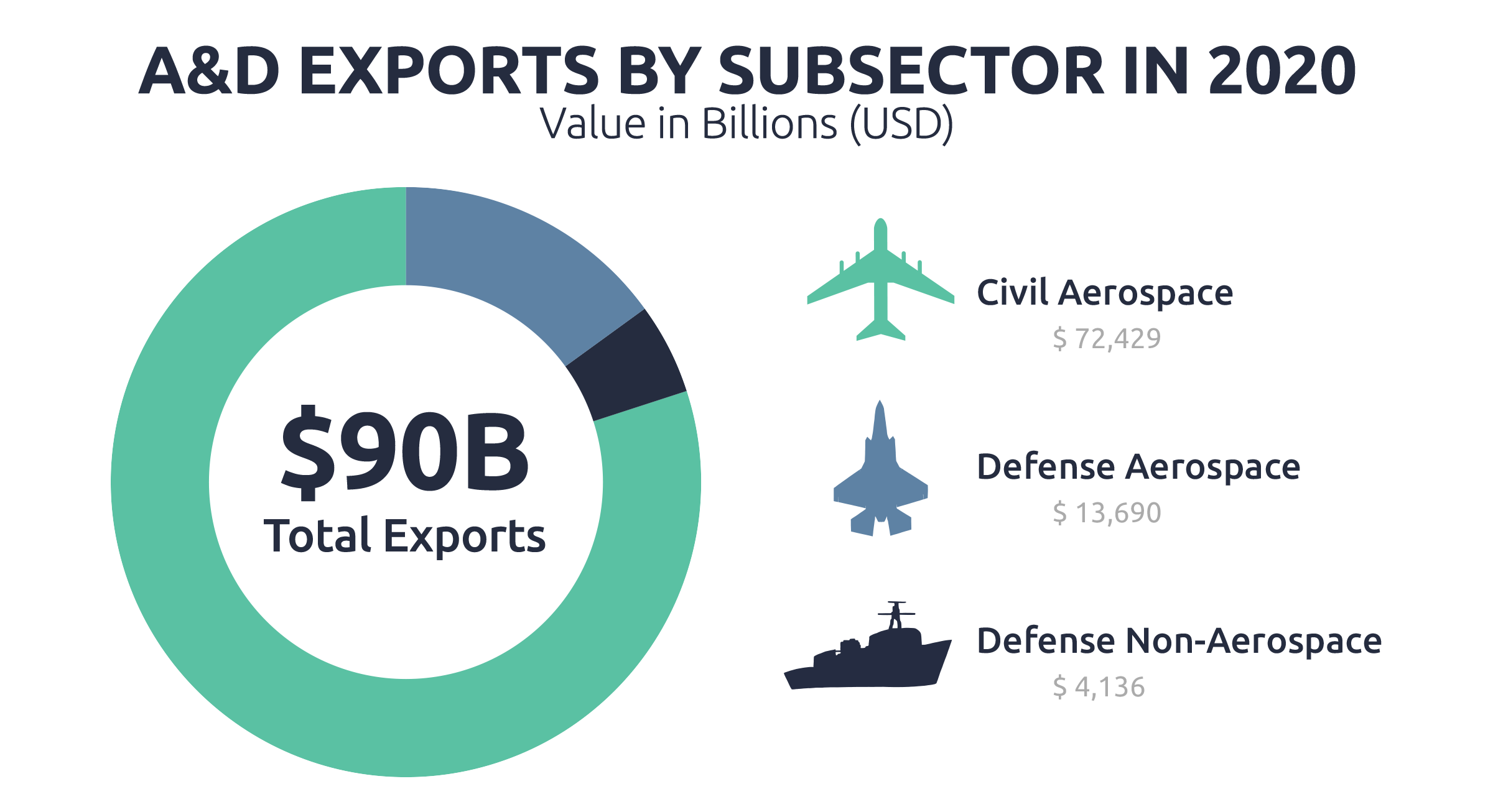

A&D Exports Dropped to $90 Billion

The impact of COVID-19 on U.S. aerospace & defense trade cannot be understated. Despite significant loss, however, A&D exports still accounted for 6.3 percent of all U.S. exports in 2020. Between 2019 and 2020, American A&D exports dropped by $57.5 billion, or 39 percent, to $90 billion.

-

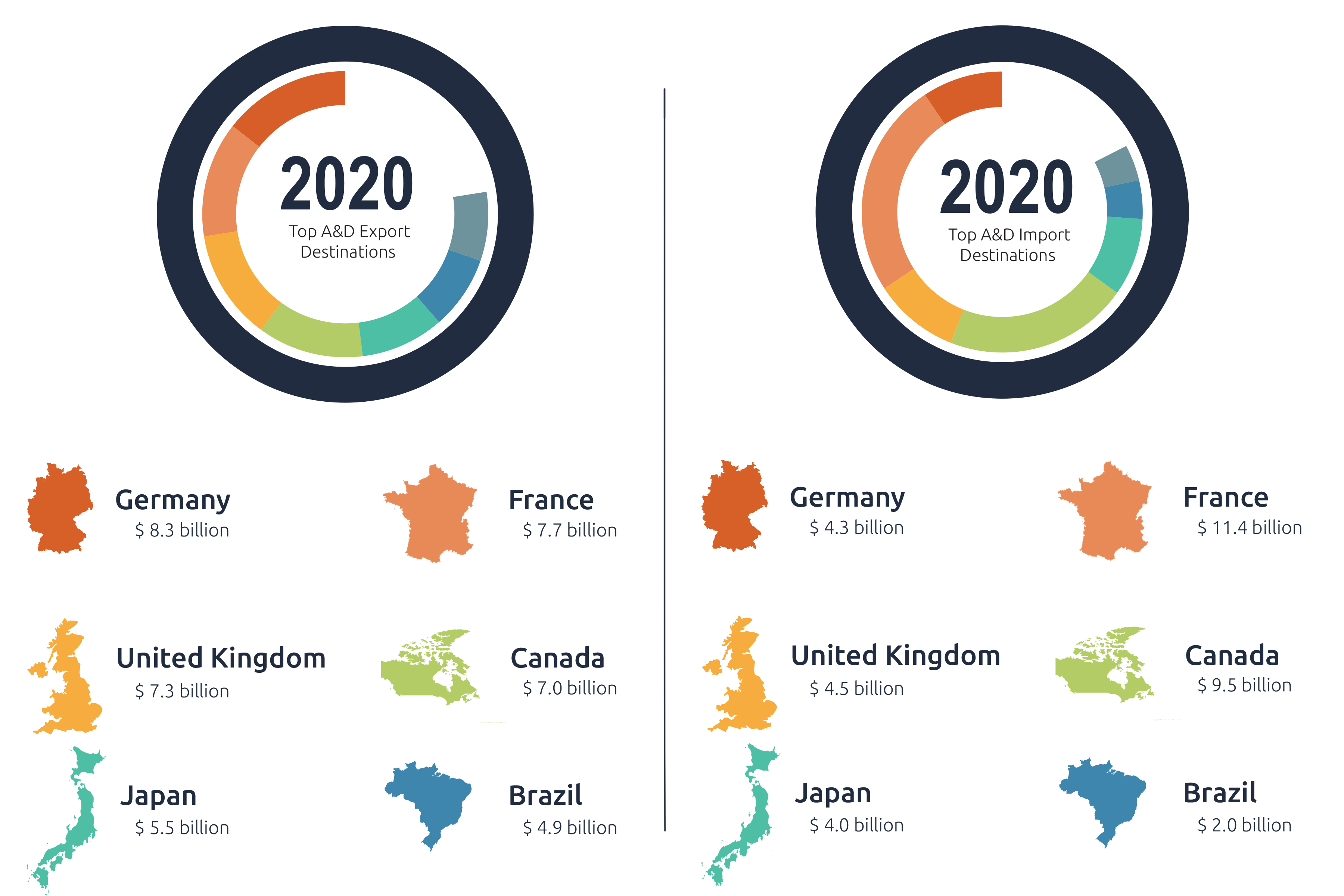

The Industry's Top Trade Partners

The leading destinations for U.S. A&D exports in 2020 were Germany, France, Canada, the United Kingdom, and Japan. Exports to these five nations collectively amounted to $36.1 billion, around 40 percent of all U.S. A&D exports.

Top origins for U.S. A&D imports in 2020 were France, Canada, the United Kingdom, Germany, and Japan, largely mirroring the nation’s export destinations and making clear the strength of America’s trade relationship with those countries.

-

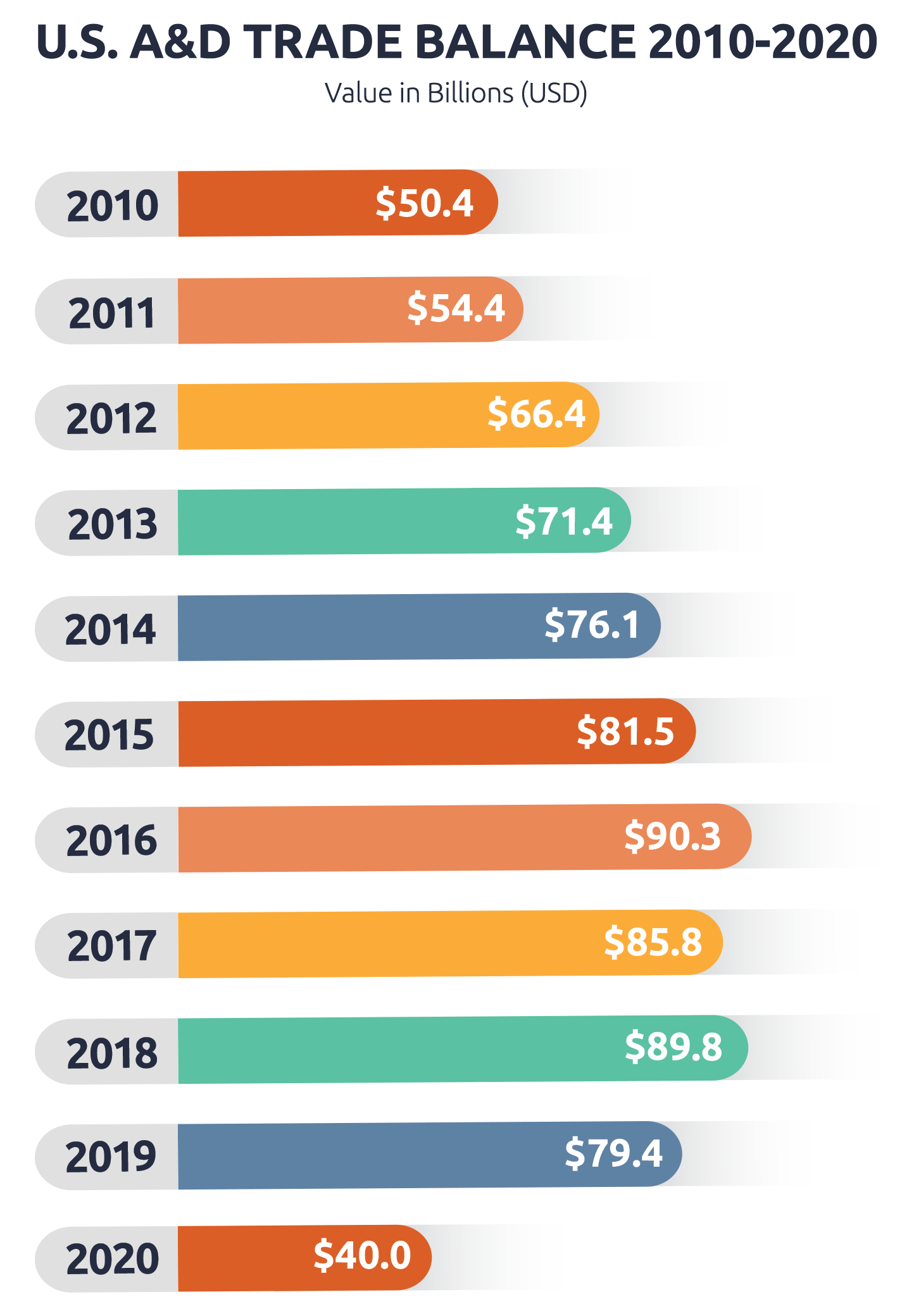

A Positive Industry Trade Balance of $40.6 billion

Despite seismic shifts in trade values, the A&D industry maintained its positive industry trade balance at a value of $40.6 billion. While nowhere near the $79.3 billion industry trade balance achieved in 2019, A&D retained its status as a leading export industry for the United States.

State Data

-

An Industry Presence in All 50 States

In 2019, the industry supported jobs and communities in all fifty states and the District of Columbia.

Click here to learn more about the A&D industry’s impact on your state.

-

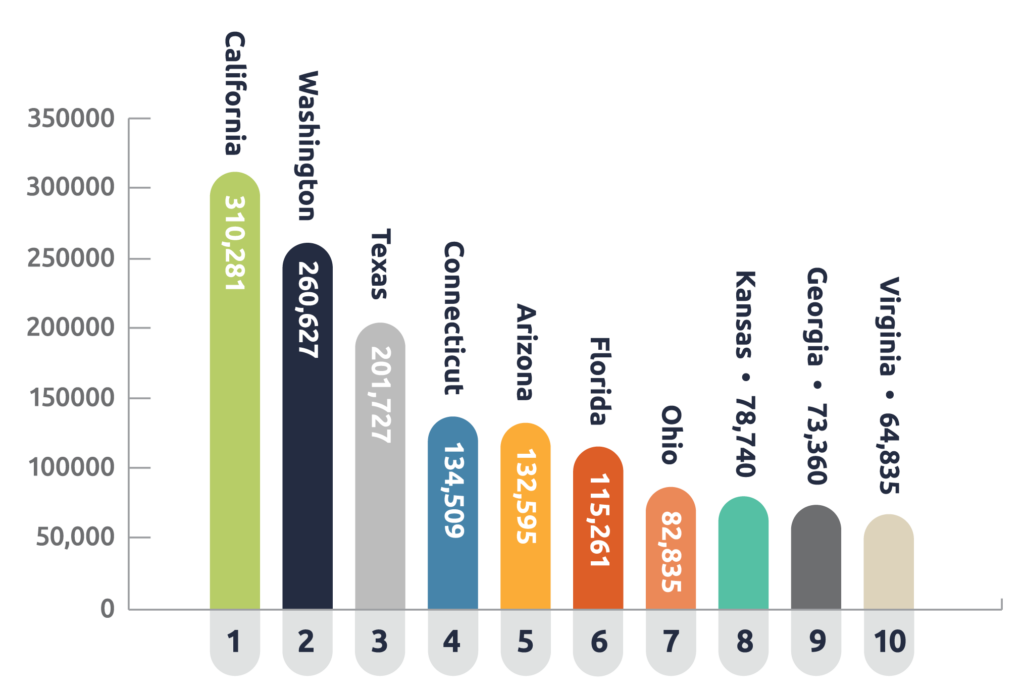

Top 10 States by A&D Employment

-

-

California

-

Washington

-

Texas

-

Connecticut

-

Arizona

-

Florida

-

Ohio

-

Kansas

-

Georgia

-

Virginia

-

-

-

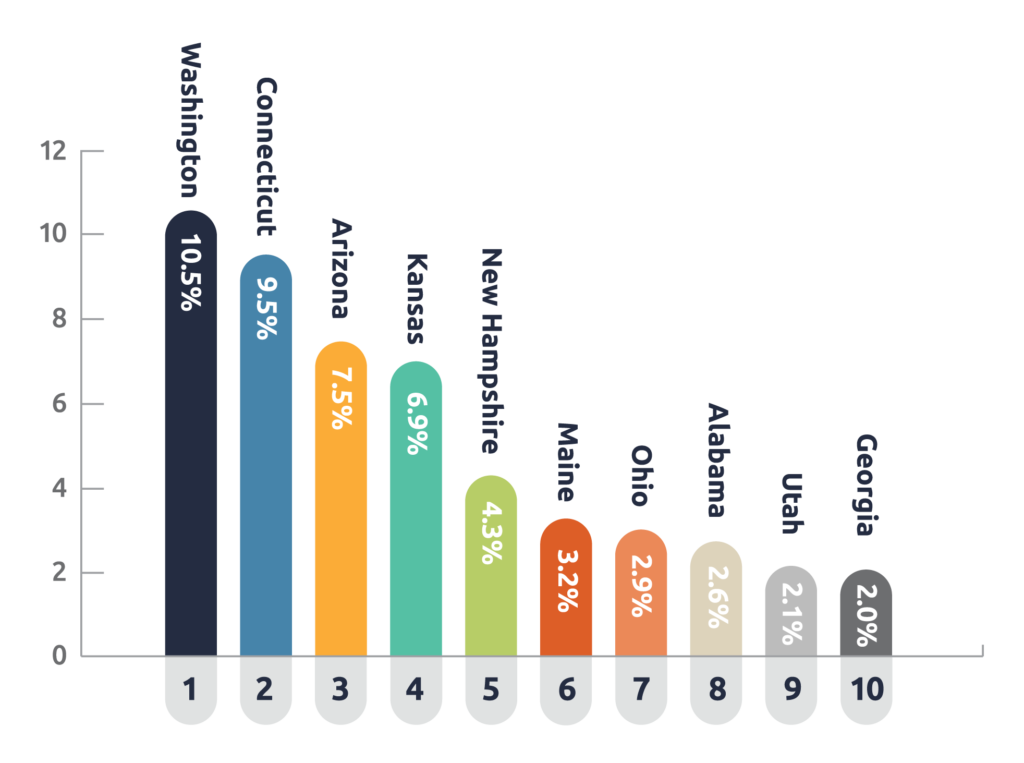

Top 10 States by Percent A&D Contribution to GDP

-

-

Washington

-

Connecticut

-

Arizona

-

Kansas

-

New Hampshire

-

Maine

-

Ohio

-

Alabama

-

Utah

-

Georgia

-

-